- Home

- News

- ESG Weekly News

- ESG International Weekly News 4/17-4/23

ESG International Weekly News 4/17-4/23

1.Canada Proposes Recycled Content, Mandatory Labelling Rules for Plastic Products

加拿大政府提案塑膠製品重新標籤以推廣循環經濟

The Canadian government has announced a series of new measures to combat plastic pollution and improve the management of plastics. These measures include launching consultations for new labelling rules, mandating recycled content in plastic packaging, and establishing a plastics registry. At present, Canadians dispose of 4.4 million tonnes of plastic waste annually, with only 9% being recycled.The proposed labelling rules aim to reduce misleading information on packaging by prohibiting the use of chasing-arrows symbols and terms like "degradable" or "biodegradable" unless specific criteria are met. For example, packaging can only be labelled as recyclable if 80% of people in a province or territory have access to recycling systems that accept, sort, and re-process the plastics. Additionally, the rules would set minimum standards for products labelled as compostable.

The government is also introducing requirements for minimum recycled content in certain types of plastic packaging, which will help support stronger and more reliable end markets for recycled plastics. This is expected to lead to improvements in recycling systems, reductions in greenhouse gas emissions, and promotion of a circular economy for plastics.

加拿大政府宣布了一系列新措施,以應對塑料污染問題和改善塑料的管理。這些措施包括為新標籤規則進行諮詢、規定塑料包裝中必須使用回收再生材料,以及建立塑料登記檔。目前,加拿大每年丟棄440萬噸塑料垃圾,其中只有9%被回收。

根據建議的標籤規則,除非滿足特定條件,否則禁止在包裝上使用追逐箭頭標誌以及“可降解”或“生物降解”等詞語,以減少包裝上的誤導性信息。例如,只有當80%的省或地區居民能夠使用接受、分類和再加工這些塑料的回收系統時,包裝才能被標記為可回收。此外,這些規則還將為標記為可堆肥的產品設定最低標準。

政府還引入了對某些類型塑料包裝的最低回收內容要求,這將有助於支持更強大、更可靠的回收塑料的終端市場。這預計將導致回收系統的改進、溫室氣體排放的減少以及推廣循環經濟。

2.China, Singapore, Partner to Scale Green Finance

中國與新加坡銀行合作推廣綠色金融

The Monetary Authority of Singapore (MAS) and the People's Bank of China (PBC) have launched the China-Singapore Green Finance Taskforce (GFTF) to deepen cooperation on green and transition finance and promote public-private collaboration for Asia's low carbon transition. The GFTF is co-chaired by Gillian Tan from MAS and Dr. Ma Jun from the China Green Finance Committee, and comprises senior representatives and sustainable finance experts from both countries. The taskforce's priorities include Taxonomies and Definitions, Products and Instruments, and Technology. Initiatives include working towards interoperability between the Singapore and China taxonomies, strengthening sustainability bond market connectivity, and piloting digital green bonds with carbon credits.

新加坡金融管理局(MAS)和中國人民銀行(PBC)宣布成立中新綠色金融工作組(GFTF),旨在加強綠色及過渡金融合作,促進公私合作,以促使亞洲實現低碳過渡。GFTF由MAS的首席可持續發展官Gillian Tan和中國綠色金融委員會主席馬軍共同主持,成員包括來自新加坡和中國的金融機構和綠色金融科技公司的高級代表及可持續金融專家。工作組的合作重點包括分類和定義、產品和工具以及技術。舉措包括在新加坡和中國的可持續經濟活動分類法之間實現互操作性,加強可持續發展債券市場的聯繫,以及試行擁有碳權的數字綠色債券。

3.CDP Adds Reporting on Plastic-Related Impact and Risks to Disclosure System碳揭露組織增加塑膠相關風險揭露項目

CDP, a climate research provider and environmental disclosure platform, has introduced the ability for companies to report on plastic-related impacts, following investors' demand for more information on plastic-related risks and exposure. In 2022, over 18,700 companies disclosed environmental data through CDP. The addition of plastic-related reporting comes after requests from investors with $136 trillion in assets and in response to various risks related to plastic pollution. The new plastics module, incorporated into CDP's water security questionnaire, covers plastics mapping, potential environmental impacts, business risks, and targets. Nearly 7,000 companies from sectors such as chemicals, fashion/apparel, food and beverage, fossil fuels, and packaging are invited to disclose plastic-related impacts.

氣候研究提供商和環境披露平台CDP宣布,為滿足投資者對公司塑料相關風險和敞口信息的需求,現已推出讓公司報告塑料相關影響的功能。2022年,超過18,700家公司通過CDP披露環境數據。在擁有136萬億美元資產的投資者要求披露塑料相關影響的情況下,CDP增加了塑料相關報告功能,以應對與塑料污染相關的各種風險。新的塑料模塊已納入CDP的水安全問卷,涵蓋了塑料定位、潛在環境影響、商業風險和目標。化學品、時尚/服裝、食品和飲料、化石燃料和包裝等行業的近7,000家公司受邀披露塑料相關影響。

4.Hong Kong Exchange to Require Climate Reporting from All Issuers Beginning 2024

香港證交所要求所有上市公司2024年氣候揭露

he Stock Exchange of Hong Kong has proposed new rules requiring all listed issuers to provide climate-related disclosures aligned with the International Sustainability Standards Board's (ISSB) upcoming Climate Standard, with the rules expected to take effect from January 1, 2024. The rules would significantly increase reporting in areas like Scope 3 emissions and climate resilience scenario analysis. To address issuers' concerns, interim provisions are included, allowing for quantitative disclosures in the first two years. The requirements cover governance, strategy, metrics, and targets, and aim to accelerate issuers' sustainability journey, strengthening Hong Kong's position as a trusted venue for capital raising.

香港聯交所提出新規定,要求所有上市公司提供符合國際可持續發展標準委員會(ISSB)即將推出的氣候標準的氣候相關披露,預計該規定將於2024年1月1日生效。這些規定將大幅增加公司在範疇3排放和氣候韌性場景分析等方面的報告。為解決公司在提高氣候報告方面的擔憂,提案包括臨時規定,允許公司在前兩年為某些披露(如範疇3排放、氣候相關風險和機遇的財務影響以及某些跨行業指標)提供量化披露。這些要求涵蓋治理、策略、指標和目標等方面,旨在加速上市公司的可持續發展之旅,鞏固香港作為吸引資本籌集的值得信賴場所的地位。

5.G7 Ministers Urge Implementation of Mandatory Climate Disclosure

G7各首長敦促實施強制性氣候披露

G7 climate and environment ministers called for mandatory climate-related financial disclosures to accelerate sustainable finance and achieve global climate goals, following the G7 Ministers' Meeting on Climate, Energy, and Environment in Sapporo, Japan. The communique included new commitments to increase renewable energy capacity, eliminate plastic pollution by 2040, and accelerate the phase-out of unabated fossil fuels. The ministers highlighted the importance of the International Sustainability Standards Board (ISSB) and urged implementation of mandatory climate disclosures beyond the G7. Additionally, they pledged to increase offshore wind capacity by 150 GW and solar PV to over 1 TW by 2030.

G7氣候和環境部長在日本札幌舉行的G7部長級氣候、能源和環境會議後呼籲實施強制性氣候相關金融披露,以加速可持續金融發展並實現全球氣候目標。公報中還包括新承諾,本十年大幅增加可再生能源裝機能力,到2040年消除塑料污染,並加速淘汰未減排化石燃料。部長們強調國際可持續發展標準委員會(ISSB)的重要性,並敦促在G7以外的司法管轄區實施強制性氣候披露。此外,他們承諾到2030年將海上風電裝機能力增加到150吉瓦,太陽光伏裝機能力增加到超過1 TW。

| Action/Commitment | Explanation |

| 強制性氣候相關財務披露 (Mandatory climate-related financial disclosures) | 實施強制性氣候相關財務披露以加速可持續金融並實現全球氣候目標 (Implement mandatory climate-related financial disclosures to accelerate sustainable finance and achieve global climate goals) |

| 可再生能源產能 (Renewable energy capacity) | 本十年內大幅增加可再生能源產能,以促進清潔能源轉型 (Significantly increase renewable energy capacity within this decade to promote clean energy transition) |

| 消除塑料污染 (Eliminate plastic pollution) | 承諾到2040年消除塑料污染 (Commit to eliminating plastic pollution by 2040) |

| 淘汰無減排化石燃料 (Phase out unabated fossil fuels) | 加速淘汰無減排化石燃料以減少溫室氣體排放 (Accelerate the phase-out of unabated fossil fuels to reduce greenhouse gas emissions) |

| 支持ISSB工作 (Support ISSB work) | 強調國際可持續標準委員會(ISSB)的重要性,並推動其在氣候相關披露方面的工作 (Emphasize the importance of the International Sustainability Standards Board (ISSB) and promote its work in climate-related disclosures) |

| 增加離岸風能容量 (Increase offshore wind capacity) | 到2030年將離岸風能容量增加到150 GW (Increase offshore wind capacity to 150 GW by 2030) |

| 增加太陽能光伏容量 (Increase solar PV capacity) | 到2030年將太陽能光伏容量增加到1 TW以上 (Increase solar PV capacity to over 1 TW by 2030) |

G7 countries' commitment to climate disclosure rules:

| Country | 永續承諾或目標 | 氣候披露規則狀態 |

|---|---|---|

| Canada 加拿大 | 2030年淘汰燃煤發電,2050年實現淨零排放,2025年保護25%的土地和海洋,2030年保護30%的土地和海洋。 | 推動強制性氣候相關財務披露 |

| France 法國 | 2050年實現碳中和,2022年關閉燃煤發電廠,2040年禁止使用一次性塑料,增加可再生能源。 | 實施歐盟公司可持續報告指令(CSRD) |

| Germany 德國 | 2045年實現淨零排放,2038年淘汰燃煤,2030年65%的電力來自可再生能源。 | 實施歐盟公司可持續報告指令(CSRD) |

| Italy 意大利 | 2050年實現淨零排放,2025年淘汰燃煤發電,增加可再生能源,減少塑料廢物。 | 實施歐盟公司可持續報告指令(CSRD) |

| Japan 日本 | 2050年實現碳中和,減少對化石燃料的依賴,增加可再生能源產能。 | 正在考慮實施強制性氣候披露規則 |

| United Kingdom 英國 | 2050年實現淨零排放,2024年淘汰燃煤發電,禁止使用一次性塑料,增加可再生能源產能。 | 已經實施強制性氣候相關財務披露 |

| United States 美國 | 2050年實現淨零排放,重新加入巴黎協議,淘汰燃煤發電,增加可再生能源和清潔技術。 | 美國證券交易委員會(SEC)即將公布氣候披露規則 |

備註:The CSRD (Corporate Sustainability Reporting Directive) is an EU regulation that requires large companies, including public-interest entities (PIEs) and non-public interest entities, with over 500 employees, to disclose non-financial and sustainability-related information. The directive aims to enhance the consistency, comparability, and relevance of sustainability information disclosed by companies, ultimately promoting transparency and long-term investment decision-making.

CSRD(企業可持續性報告指令)是一項歐盟法規,要求擁有超過500名員工的大型公司(包括公共利益實體(PIE)和非公共利益實體)披露非財務和可持續性相關信息。該法令旨在增強公司披露的可持續性信息的一致性、可比性和相關性,從而促進透明度和長期投資決策。

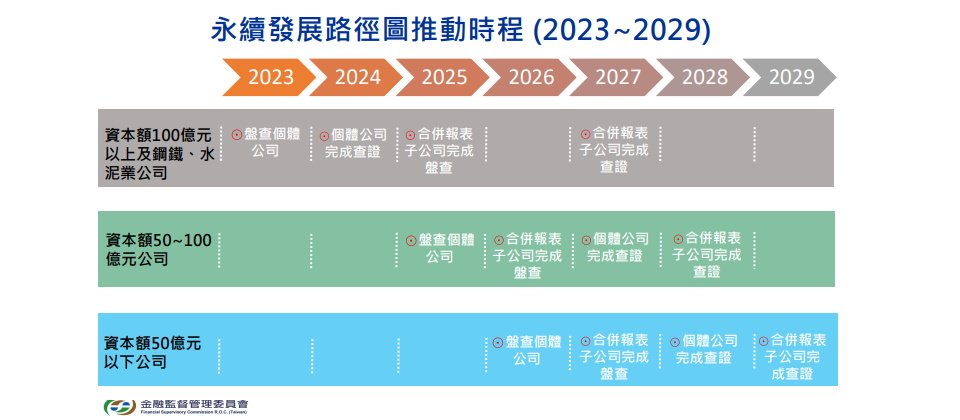

台灣 2050年實現淨零排放,淘汰燃煤發電,增加可再生能源產能,減少塑料廢物。 臺灣目前金管會要求上市櫃公司和金融機構自2024年起皆須在年報中強制揭露碳排在內的氣候資訊,要求全體上市櫃公司於2027年前完成溫室氣體盤查,2029年前完成溫室氣體盤查之查證

Taiwan - Achieve net-zero emissions by 2050, phase out coal-fired power, increase renewable energy capacity, and reduce plastic waste. Taiwan's Financial Supervisory Commission currently requires listed companies and financial institutions to mandatorily disclose climate information, including carbon emissions, in their annual reports starting from 2024. All listed companies are required to complete greenhouse gas inventory by 2027 and have the inventory verified by 2029.